- Analytics

- Market Overview

Slowdown of China’s economic growth - 19.10.2015

On Friday the US stocks prices were on the increase in line with the US dollar index. The positive macroeconomic and corporate information contributed to that. The University of Michigan Consumer Confidence Index for October exceeded the forecasts reaching 92.1. The quarterly General Electric report was better than expected and resulted in the company’s stocks price growth of 3.4%. The majority of the market participants are currently expecting the gross earnings of the index S&P 500 companies to fall down by 3.9% in the 3rd quarter. The US industrial production contracted in September by 0.2% for the second month in a row still remaining positive year-on-year (+1.8%). The US stock exchange trading volume was 12% lower on Friday than the average in 20 trading days amounting to 6.6bln shares. Today no important macroeconomic data is expected in US.

The European stock markets keep growing. The pan-European FTSEurofirst 300 index reached the high of 5 weeks. The Chinese GDP data for the 3rd quarter released early in the morning showed the growth has contracted a bit but remained above the forecast at 6.9%. The German retailer Metro awaits the sales to increase by 1.3% in the 4th quarter, its stocks added 3.6% on this news. The Deutsche Bank stocks went up by 3.2% on the news its investment business is to be reorganized and the top management to be reduced. The euro is weakening on concerns that the ECB will announce on its next meeting due on Thursday the further loosening of its monetary policy to fight deflation and support the EU economy. Today no important macroeconomic data is expected in EU.

Nikkei index is declining today after two days of growth. We see no particular negative news. The Japanese stocks went down following the Chinese stock index Shanghai Composite which, in its turn, reacted on the Chinese GDP growth slowdown to the lowest since 2009. The Sumitomo Mitsui and Asahi Kasei stocks lost about 6% amid expectations that they can be fined for the breach of the building legislation. Tomorrow at 7:30 am CET the supermarket sales performance and at 8:00 am CET the final factory orders for September will be released in Japan.

Some commodities futures have went down a bit on the news of the Chinese GDP growth slowdown. In particular, the oil prices fell. In September its consumption in China decreased by 1.3% month-over-month and by 0.1% year-over-year amounting to 10.13mln barrels a day. The Chinese oil production increased by 2.7% to 4.32mln barrels a day in September. The Austrian oil company OMV released its forecast of the global oil prices. In 2016 it is expected to be $55 a barrel, in 2017 — $70, in 2018 — $80 and in 2019 — $85. The United States started the process of lifting the sanctions imposed on Iran. The Iranian Real rate stabilized below 30 000 a dollar two months ago on expectations of the oil export increase. Amid the low oil prices the number of active oil-drilling rigs in the US diminished for the 7th week in a row to reach the low since July 2010 of 595 units. This is about three times less than the high of last October (1609 units). The markets expect the US oil production to contract in the 4th quarter by 255 thousand barrels a day.

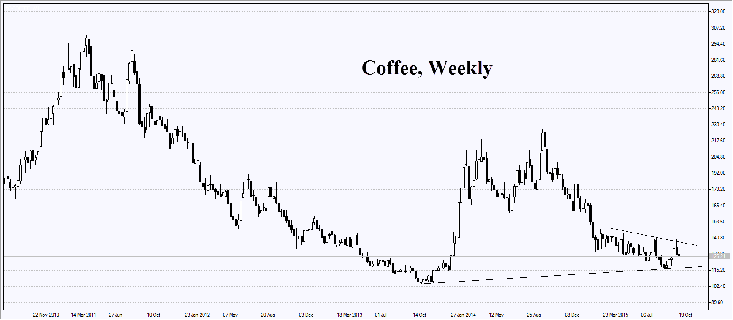

On Friday the fall in coffee prices was the most severe in 7 months. The forecaster Commodity Weather Group informed about the possible rainy weather in Brazil for the following 10-15 days. This may contribute to the larger coffee yield. The additional price growth factor is the green coffee stocks in the US reaching the 12-year high.

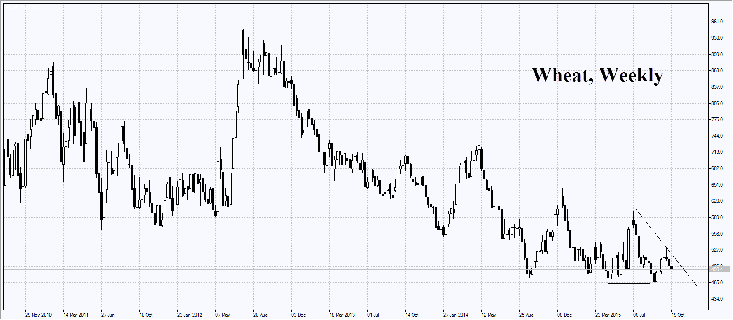

The wheat prices are falling down for the 4th consecutive day after the US Department of Agriculture forecast its global stocks for 2015/16 are to hit the record high of 228.5mln tonnes. The Consultancy Strategie Grains revised up its forecast of the wheat crop in eurozone by 2mln tones to 149.5mln tonnes.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also